Homepage Teardowns: What 6 Top SaaS Companies Get Right (and Wrong)

Bonus: Why sales-led motions can work below 10k€ ACV

Hey - it’s Alex!

Today, we’ll cover 3 things:

1️⃣ Teardown of 6 Top SaaS Homepages (+ learning you can apply for your website)

2️⃣ Why sales-led motion can work for <10k€ ACV

3️⃣ How many customers do you need to know your ICP?

It’s about something most founders quietly avoid: Taking a clear GTM bet.

Let’s get into it. 👇

In case you missed the last 3 episodes:

✅ Insights from 15+ GTM audits

✅ The Best of MRR Unlocked 2025

✅ The Ultimate Founder & Team LinkedIn Playbook

Homepage Teardown of 6 Top SaaS Companies: What’s Good, What’s Bad

For this issue, I partnered with Maximilian Fleitmann, founder of Magier - a leading design-as-a-service agency for Startups and reviewed 6 SaaS/AI homepages.

The teardown includes: Attio, Clay, Jimo, Fin, Sastrify, and Introw

We flagged:

✅ What works

❌ What doesn’t

🔥 What we’d change immediately

We turned it into a Figma file with concrete comments you can use for your own homepage.

🟢 Green sticky notes = really good things

🔴 Red sticky notes = things that need optimization

Instead of walking through all 6 here, I’ll highlight a few recurring patterns that showed up across multiple pages.

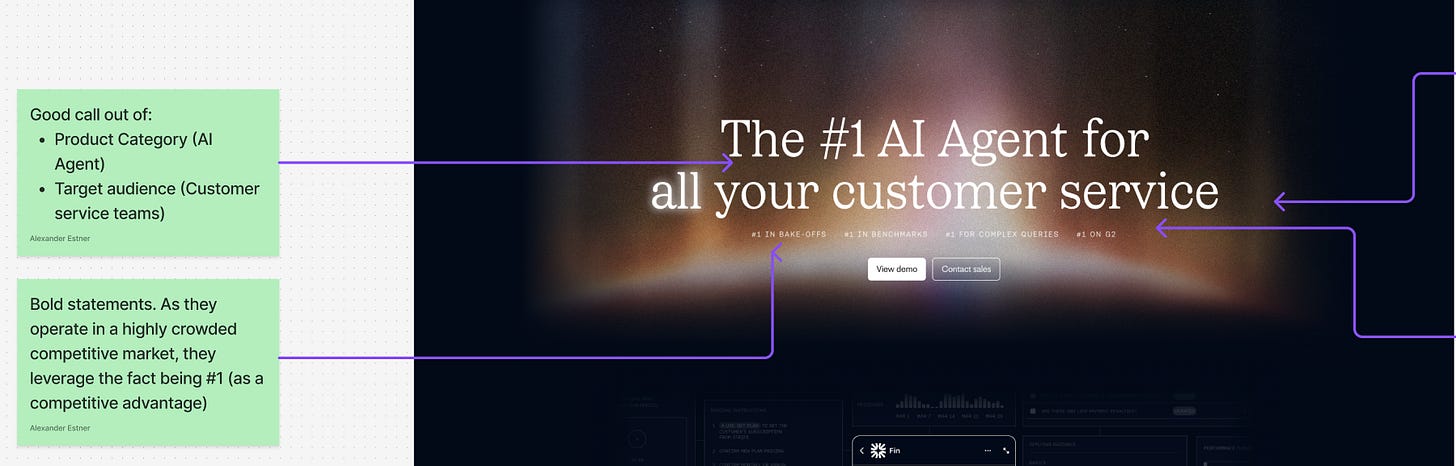

🟢 Good one #1: Clear “Who it’s for” above the fold

On the strongest homepages, it was immediately clear:

Who the product is for

What the product is/does

No abstract slogans.

No technical feature dump.

Just a concrete statement that lets the right buyer think:

“This might be for me.”

That one decision already does a lot of qualification work for you.

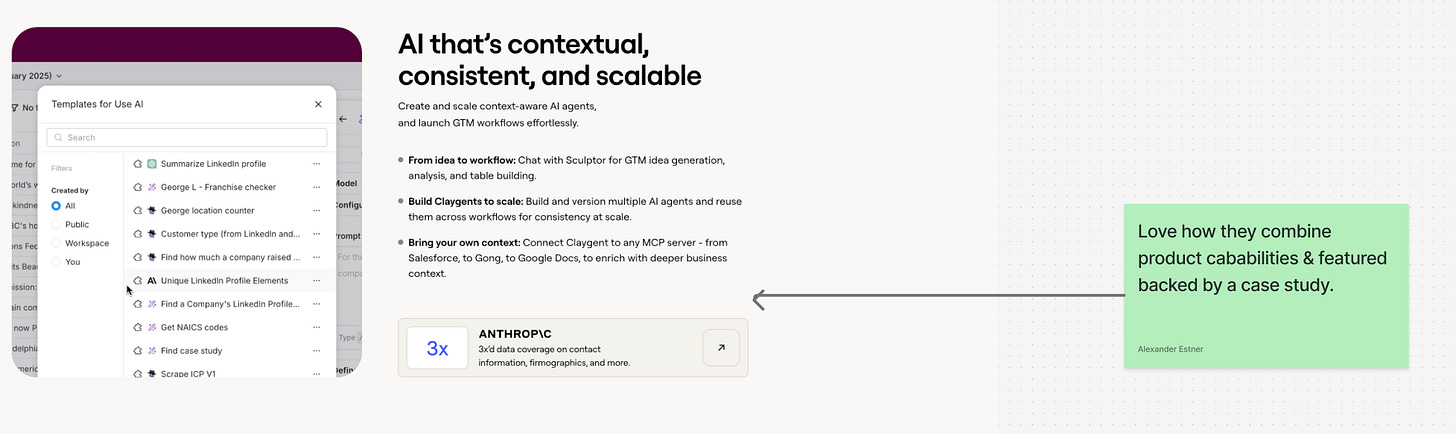

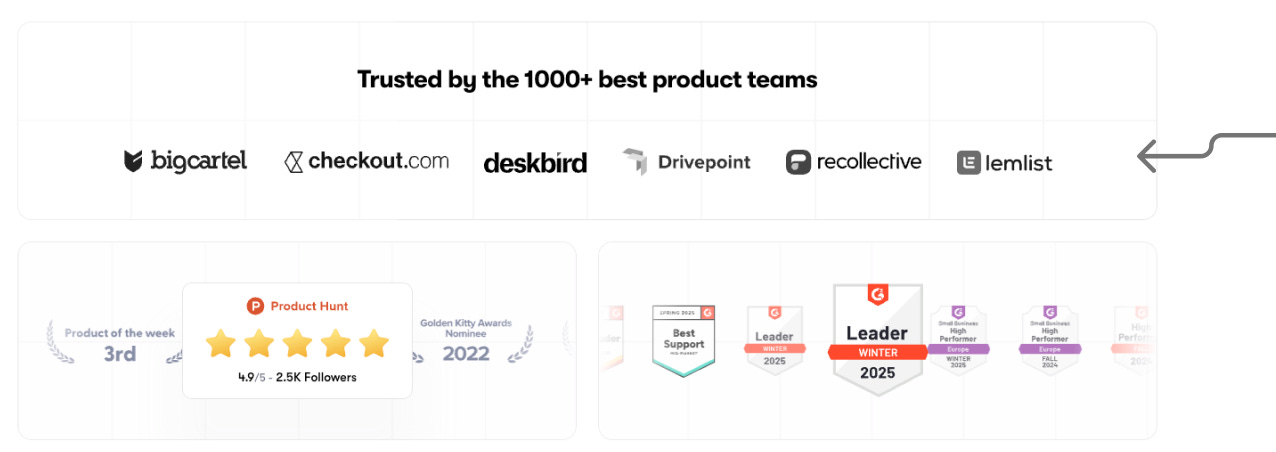

🟢 Good one #2: Innovative ways to add social proof elements

We saw several strong approaches to social proof, far beyond simple logo carousels.

👉 Adding ‘read case study’ links to the logos

👉 Backing product capabilities with relevant case studies

👉 Adding badges, reviews, and trust elements as supporting signals

The key difference: Social proof wasn’t decorative, it was contextual.

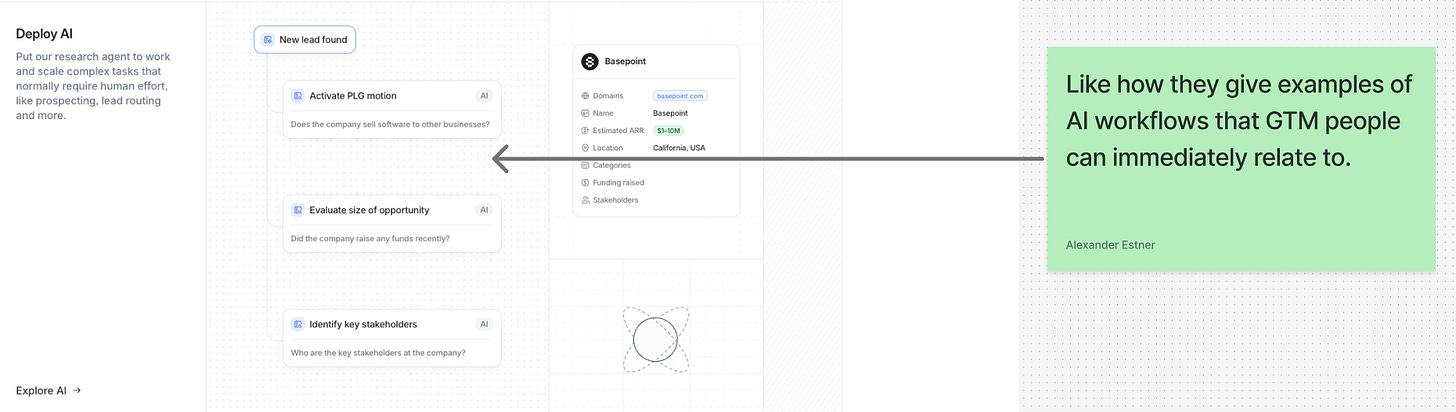

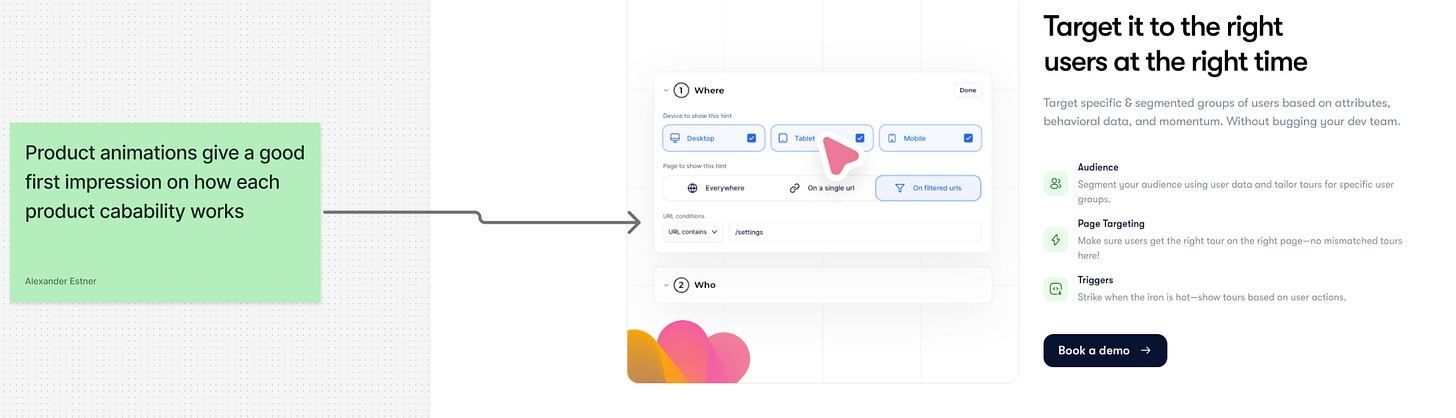

🟢 Good one # 3: Product visuals buyers can actually relate to

Instead of abstract mockups or generic UI shots, the best homepages showed:

Realistic examples

Familiar use cases

Screens buyers could imagine themselves using

This immediately creates a better first impression of:

How the product works

Where it fits into the buyer’s workflow

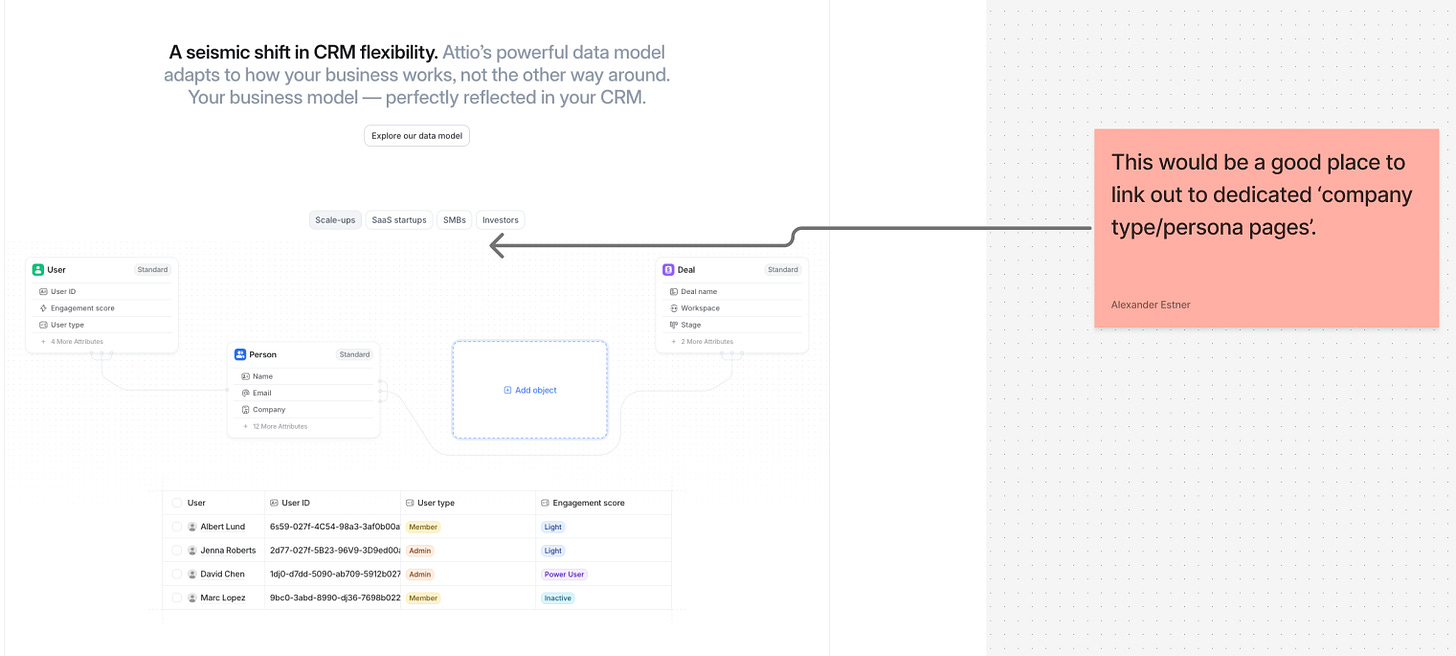

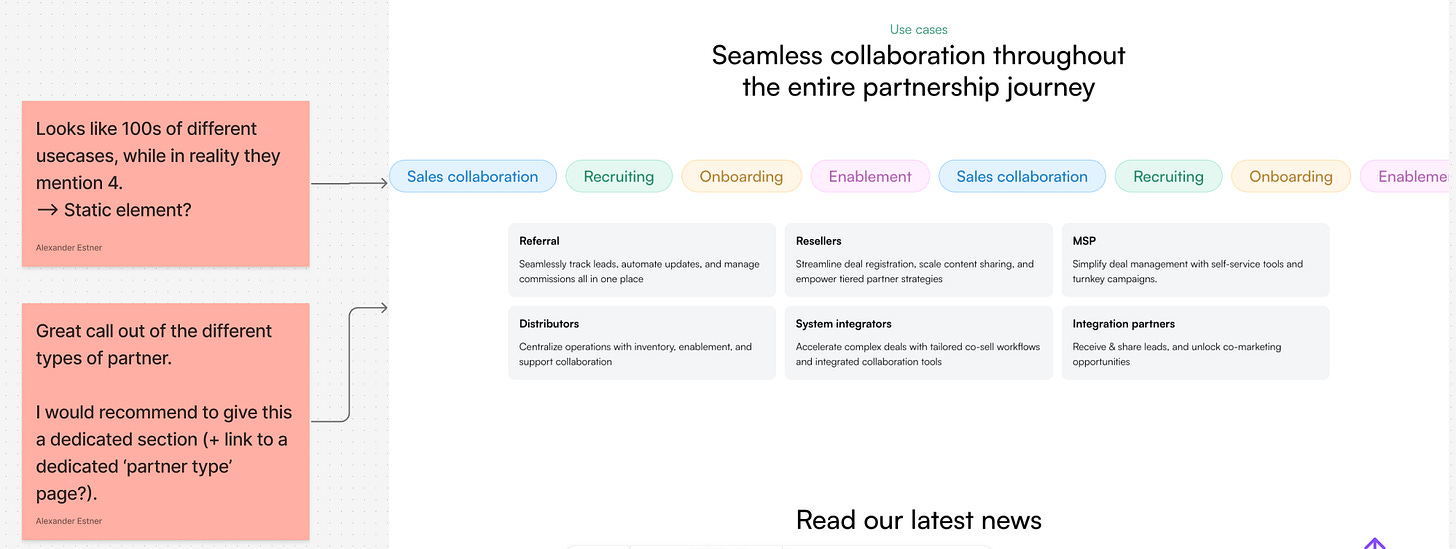

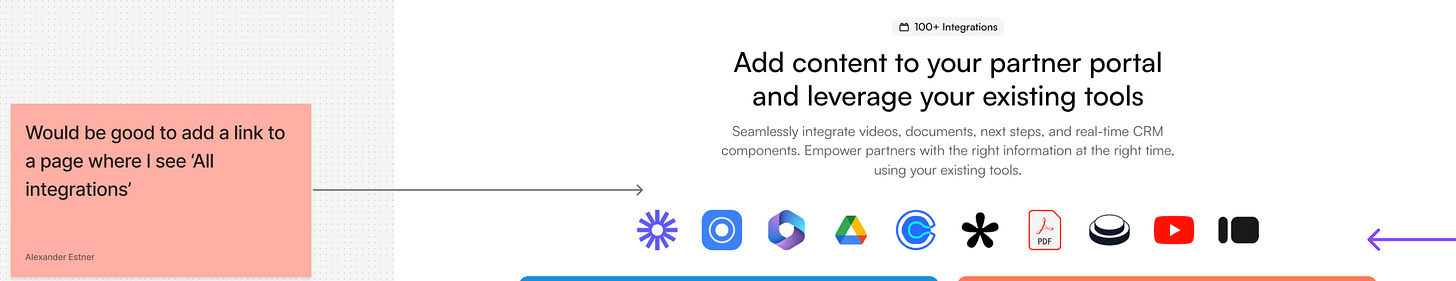

🔴 Example 1: Missing entry points for deeper pages (product pages)

Your homepage is your core positioning asset, but it can’t answer every detailed question.

That’s why strong homepages guide visitors to relevant sub-pages, most often product pages.

What was missing on some pages:

❌ Links to dedicated ‘company type/persona pages’

❌ Clear path to different partner type pages

❌ Central page listing all integration partners

These entry points would guide buyers further in their evaluation.

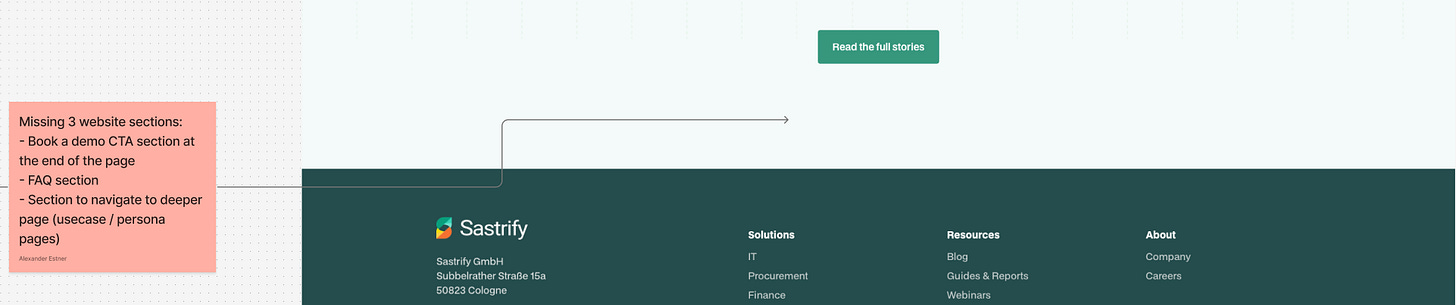

🔴 Example 2: Missing ‘end-of-the-page’ FAQ & CTA section

The homepage ends with the ‘case study’ section, but misses 2 critical sections:

❌ Call to action section

❌ FAQ section

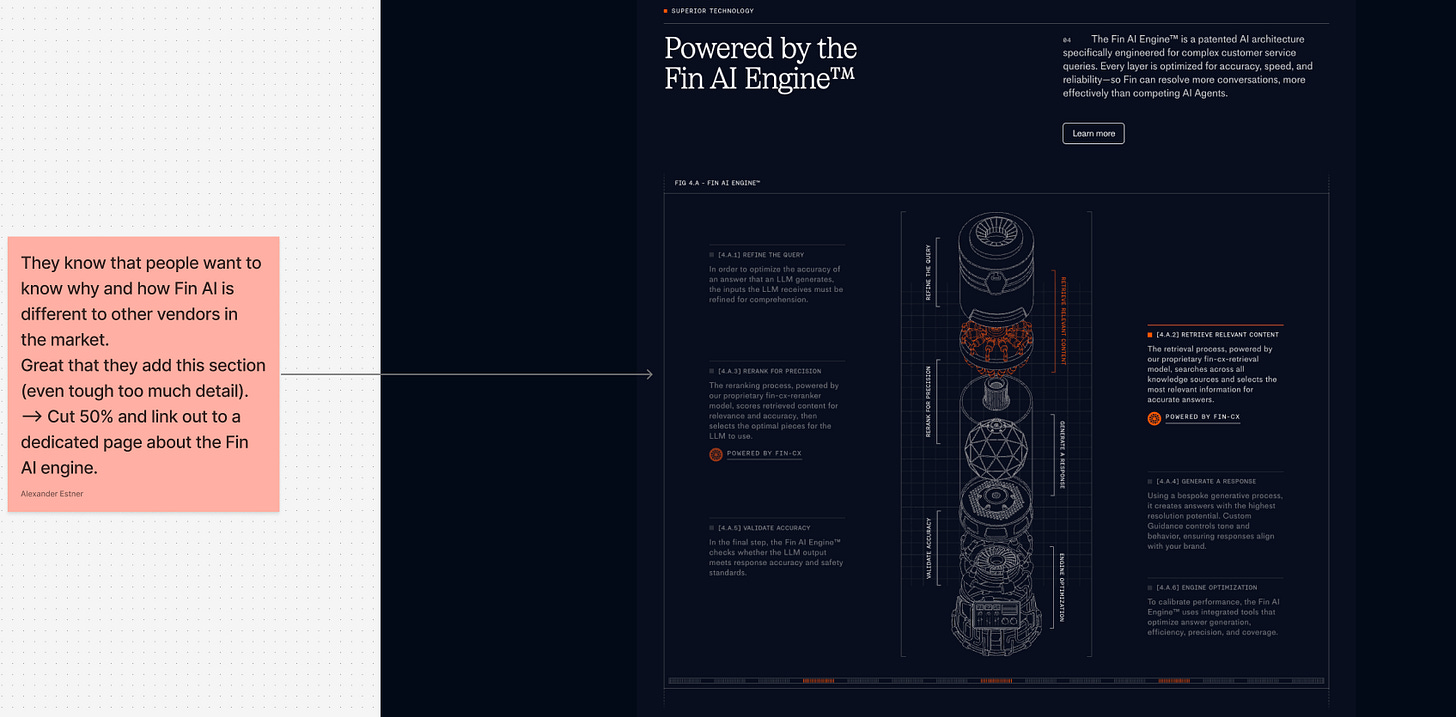

🔴 Example 3: Too much detail on the homepage

Your homepage doesn’t need to answer all questions.

Its job is to:

Qualify the right visitors

Create clarity

Guide people to the next step

In the case of Fin AI, for example, the homepage goes very deep into explaining how it differs from other AI agents.

That’s a valid topic — but in our opinion, the execution is overkill:

Too much text

Too much detail

👉 Solution: Cut ~50% and move the depth to a dedicated page (e.g. “How the Fin AI engine works”).

P.S. Want to see a great way to add a ‘competitor comparison’ on your homepage? Check out Cloudtalk’s homepage section.

Full homepage teardown

Get the full teardown of 6 homepages with detailed comments in a shared Figma file.

If you’re currently iterating on your homepage, this will save you weeks of trial and error.

Sales-led motion for <10k€ ACV

Everyone says you can’t run a sales-led motion with sub-10k€ ACVs.

That’s not true.

It can be fine, especially if you’re a founder between 0€ and your first 1–3M€ ARR.

The real problem is that most founders look at the wrong indicator.

ACV alone doesn’t tell you if sales works

ACV is not the deciding factor for whether a sales-led motion is healthy.

What actually matters are 4 things.

1️⃣ CAC payback period (fully loaded)

The real question is:

How long does it take you to recover your customer acquisition costs and start making money?

At an early stage:

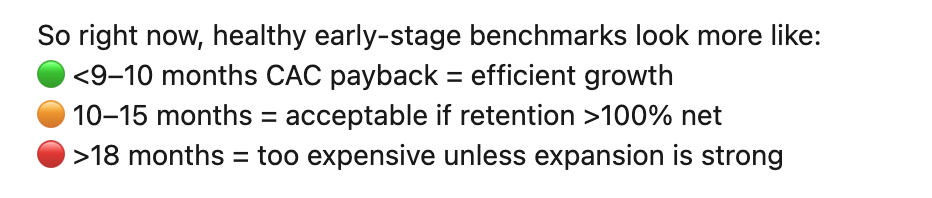

🟠 Anything below 12 months can be acceptable

🟢 Below 6 months is great

Even Douwe Wester has said that 10–15 months can still be acceptable, depending on context.

If you’re bootstrapped, your thresholds might be tighter, but the principle stays the same.

If your CAC payback works, the ACV is not “too low for sales” by default.

2️⃣ ARR signed per AE

The second key metric is how much ARR each sales rep signs.

If your reps can sign enough ARR per year, sales can scale at least initially.

With healthy quotas (for example 4–6× OTE):

Scaling with “more humans” can be fine

Especially for the first 2–3 sales reps

This is not about building a perfectly efficient sales org. It’s about making sales work at your current stage.

But this only works with an efficient sales motion.

Sales-led below 10k€ ACV only works if the motion itself is tight.

That usually means:

🟠 Win rates above 20%

🟠 Sales cycles below 90 days

🟠 Mostly inbound-driven demos

What you can’t afford at <10k€ ACV

❌ heavy outbound

❌ field sales,

❌ long sales cycles.

But if you get 1️⃣ CAC payback and 2️⃣ ARR per AE right, these problems usually disappear automatically.

3️⃣ Market maturity, product complexity & phase of the company

Whether a sales-led motion works also depends on a few structural factors:

👉 Maturity of the market

👉 Complexity of the product

👉 Phase of the company

In very mature markets (e.g. CRM, webinars, accounting, email automation), buyers are usually well educated. Human assistance adds less value.

In more complex categories (e.g. ERP software, payment infrastructure, data warehouses, HR operating systems), buyers benefit significantly from human interaction.

And if you’re early, there’s one important thing many founders miss:

This phase is not primarily about sales efficiency.

It’s about learning.

Sales, early on, is a powerful way to:

👉 Learn how customers buy

👉 Understand objections

👉 Improve positioning

👉 Build the right sales foundation

Going full PLG or sales-assisted PLG too early often kills that learning.

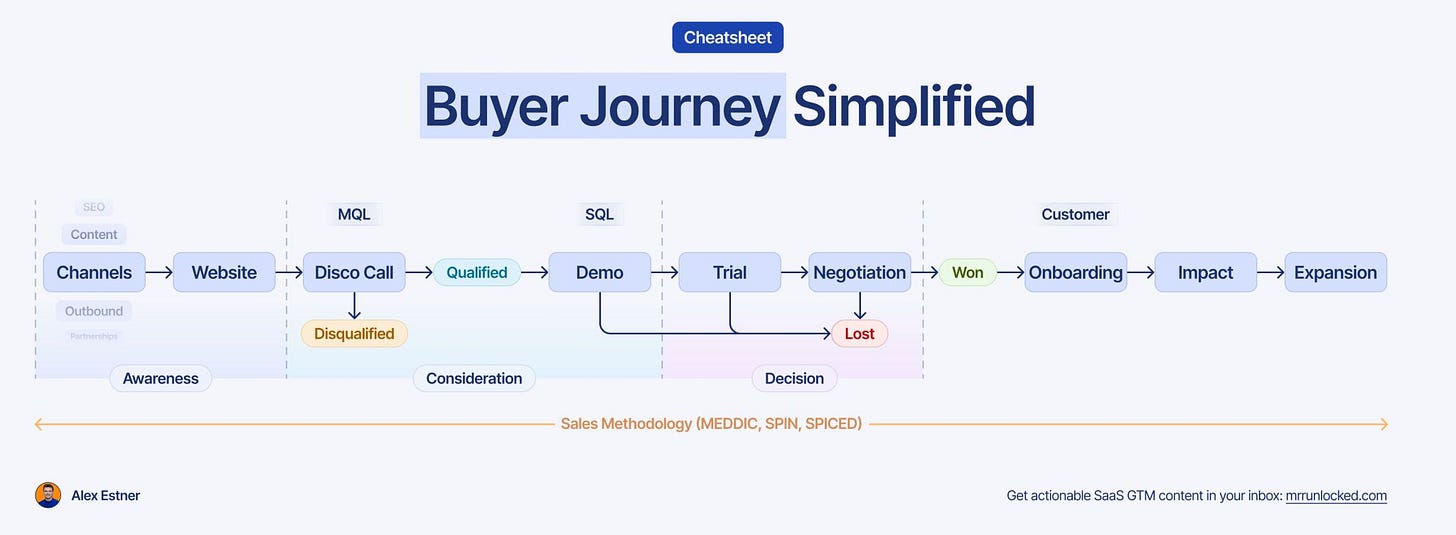

4️⃣ Design the right sales process for you

There is no single “correct” sales process you can copy.

Every SaaS company already has a sales process, whether intentional or accidental.

The problem is that many founders never define theirs.

If you don't know what your sales process looks like,

you can't guide your prospects from first touchpoint to closing.

When I work with the founders inside my 6-month GTM advisory we focus on clearly defining:

✅ Your primary CTA

→ Book a call? Start a trial?

✅ What happens in the first call

→ Short discovery or full demo?

✅ What defines a qualified lead

→ Clear MQL / SQL criteria

✅ When a deal is opened in the CRM

→ Explicit entry rules

✅ Next steps after the call

→ Technical deep dive? Trial phase?

✅ What happens after closed-won

→ Onboarding, activation, handover

✅ How you work with existing customers

→ Churn signals, expansion, retention

Write it down.

Ideally, as a simple visual flow.

3 tools and links for founders and GTM operators

👉 Run your (signal-based LinkedIn + Email) outreach campaigns with Lemlist

👉 Get early access to my new Positioning & Messaging Framework

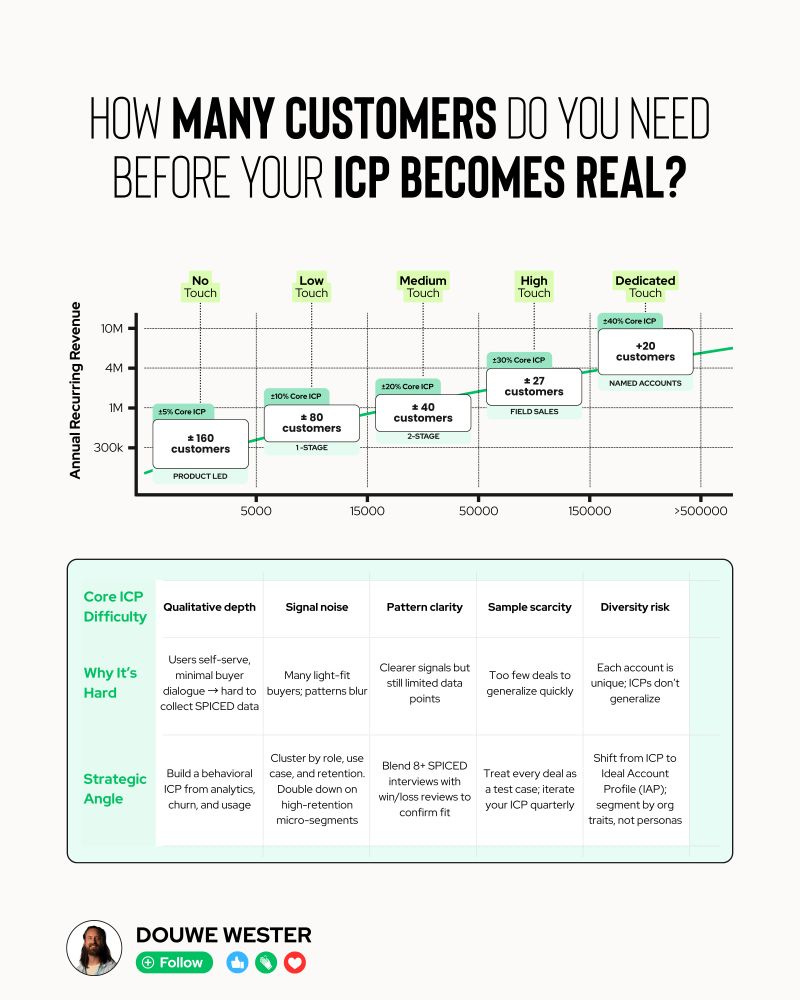

👉 How many customers do you need before your ICP becomes real?

That’s it for today.

See you in 2 weeks.

3 ways I help founders build a strong GTM foundation 👇

1️⃣ Use my free GTM library with 50+ free resources (guides, templates, workbooks, and tools) to build a strong GTM foundation (helped 5000+ SaaS leaders)

2️⃣ Get a 360° GTM audit of your status quo + a custom 6-month action plan

3️⃣ Work 1-on-1 with me - GTM Advisory for SaaS founders from €0 to €1 million ARR

The CAC payback framing is way more useful than fixating on ACV alone. I've seen founders get paralyzed trying to fit into arbitrary ACV buckets when their actual unit economics were totally workable. The point about sales-led being a learning mechan ism early on is underrated, especialy in complex categories where buyer education needs active facilitation.