Insights from 15+ GTM audits

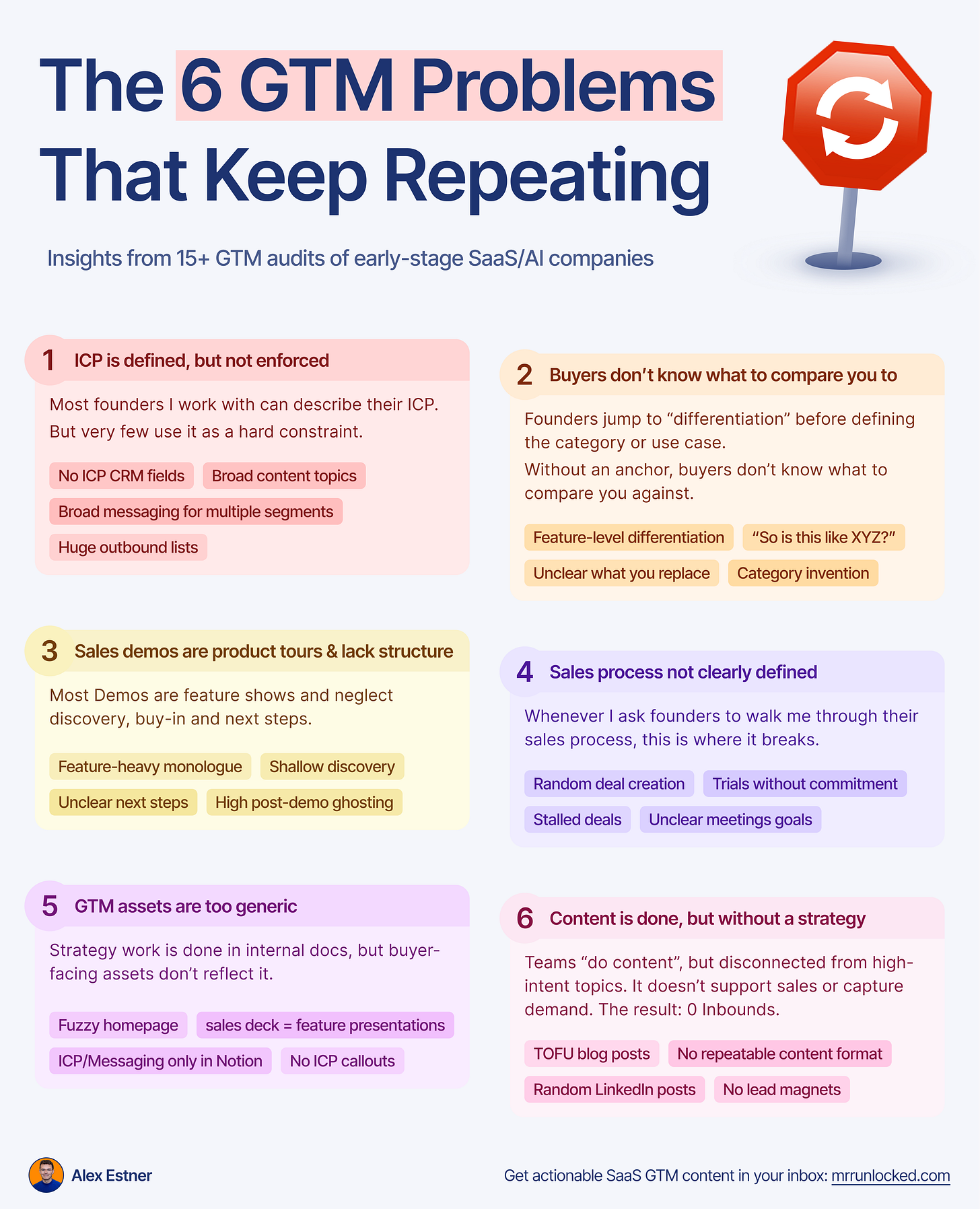

The 6 GTM problems that keep repeating

Hey - it’s Alex!

This is the first MRR Unlocked episode of 2026.

Over the last few months, I’ve done over 15 GTM audits across various B2B SaaS companies.

Different markets.

Different ACVs.

Different stages (all between 0€ and 1€ million ARR).

Yet the same GTM problems keep showing up.

Not because founders are sloppy.

Not because the product is bad.

Not because they don’t execute fast enough.

But because GTM is treated as a collection of independent activities, not a system.

Which is why many founders feel busy, ship constantly, and still struggle to create momentum.

Here are the 6 GTM mistakes I see over and over again.

Let’s dive in. 👇

📌 Early Access: The B2B SaaS Sales Demo Toolbox

1. ICP (Ideal Customer Profile) is defined, but not enforced

Pattern

Almost every founder I work with can describe their ICP in a document.

Very few actually use it as a hard constraint in day-to-day GTM decisions.

The ICP exists, but it doesn’t actively shape who you attract, how you sell, or what you prioritize.

What this looks like in practice:

❌ Website messaging speaks to multiple segments (or to none)❌ Sales demos look the same for every prospect❌ CRM has no mandatory ICP qualification fields❌ Content topics are broad and generic, not tailored to one sharp ICP❌ Outbound lead lists are huge, but response rates are weak❌ Nobody can clearly articulate an Anti-ICP❌ ICP assumptions remain unchanged even after 20–30+ customers👉 This shows up in almost every audit I do, even in teams with “good” ICP docs.

How to fix:

✅ Make the ICP explicit on the homepage (who it’s for/ not for)✅ Tailor demo structure and examples by ICP segment✅ Add mandatory ICP fields in your CRM (industry, size, use case, etc.)✅ Define clear disqualification criteria and actually enforce them✅ Review pipeline monthly by ICP segment (win rate, ACV, sales cycle)✅ Analyze your customer regularly to fine-tune your ICP (based on data)Examples of my GTM audit:

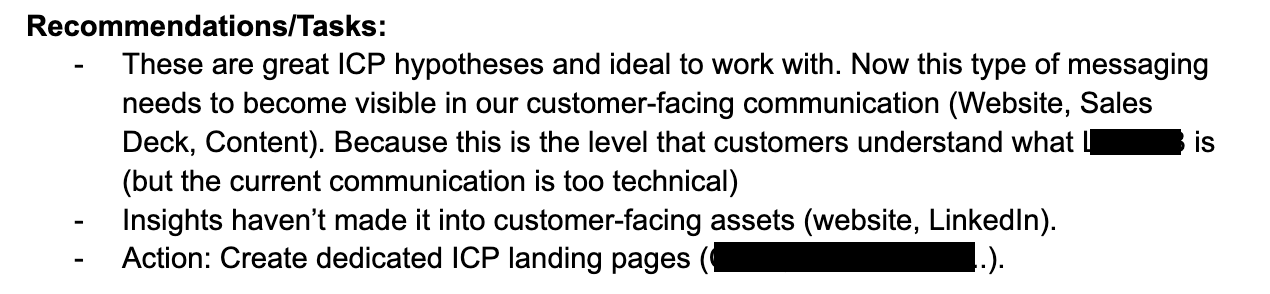

In multiple audits, the ICP work was excellent: clear segments, triggers, pains.

But none of it showed up on the website, demos, or LinkedIn.

If your ICP only lives in a doc, it’s not an ICP.

It’s a hypothesis.

Another company had revenue (200k€ ARR) and 20+ customers (from different segments and for different usecases; which is completely fine for the hustle phase), but couldn’t clearly say which segment actually converts best, because ICP data wasn’t tracked and never properly analyzed.

So if you feel like you have a ‘good ICP’ on paper, head over to your Website, CRM, Demos and double check if you also enforce it.

Resources for you:

1. ICP Framework

2. Review existing customer regulary to find your best-fit customers.2. Buyers don’t know what to compare you against

Pattern:

Founders jump straight into “differentiation” before clearly defining the product category or primary use case. So the positioning lacks a clear anchor.

So when buyers can’t place you in a category, they don’t know what to compare you against. This makes evaluation slow and confusing.

What this looks like in practice:

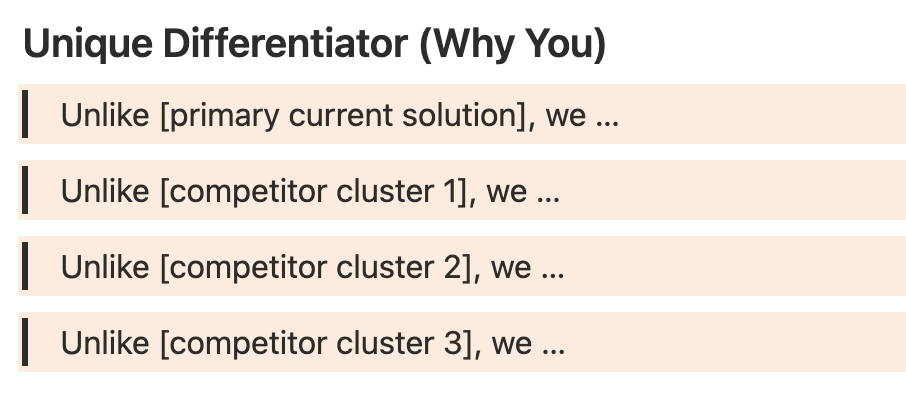

❌ Prospects ask: “So is this like X?”❌ Confusion about what you replace (Excel, incumbents, point tools)❌ Vague homepage language (“AI-powered”, “all-in-one”, “modern platform”)❌ Category invention happens too early❌ Internal debates about competitors❌ Differentiation sounds generic because it isn’t anchoredHow to fix:

✅ Decide first: category positioning or use-case positioningChoose: category positioning first, use-case positioning if category doesn’t exist

✅ Use differentiation within the category, not instead of it✅ Write one clear category sentence: “We’re a X for Y”✅ Explicitly name the primary alternative you replace (status quo)✅ Define 2–3 competitive alternative buckets:Status quo (Excel, manual workflows, agencies)

Incumbent tools

Direct Competitors

✅ Articulate 2–3 sharp talking points:✅ Build comparison and alternatives pages to reinforce the categoryExamples of my GTM audit:

In one audit, the company served multiple customer segments and use cases.

As a result, buyers didn’t know whether the product was a point solution, a platform, or an alternative to existing tools, which led to longer demos, stalled decision and long sales cycles.

They faced confusion around what product category they really fit into.

As a result, there was confusion on the category, the copy was fluffy and generic and they failed to guide buyers to the right solution.

“If you care about X, Y is a good fit for you.

But if you value Z, we are the best solution for you”

Unlike this example, where they could clearly define what the product is, who they compete with, and how they are different.

Ressources:

1. Positioning 101 (Product Category vs. Usecase Positioning)

2. My new Positioning & Messaging Framework (Get early access)3. Sales demos are product tours and lack structure

Pattern:

Most Demos are feature shows and neglect discovery, buy-in and next steps.

This means the demo is mainly designed to show the product, but rarely optimized to help the buyer make a decision.

What this looks like in practice:

❌ Shallow discovery (no urgency, no impact, no decision process)❌ Feature-heavy monologue with little buyer engagement❌ Same demo flow regardless of persona or use case❌ No explicit “success criteria” for the next step❌ High post-demo ghostingHow to fix:

✅ Treat the demo as a decision-making moment, not a walkthrough✅ Follow a clear 10-step demo structureIntro → Time Check → Agenda → Discovery → Buy‑In Summary → High-level Product Framing → Tailored Demo → Pricing → Recap → Next Steps

✅ Run structured discovery before showing the productSituation → Pain → Impact → Critical event → Decision

✅ Use “mini check-ins” after each key feature (to validate relevance and buy-in)✅ Recap pains and quantify impact before showing pricing/next steps✅ End with a clear mutual plan (who, what, by when) + next meeting scheduledExamples of my GTM audit:

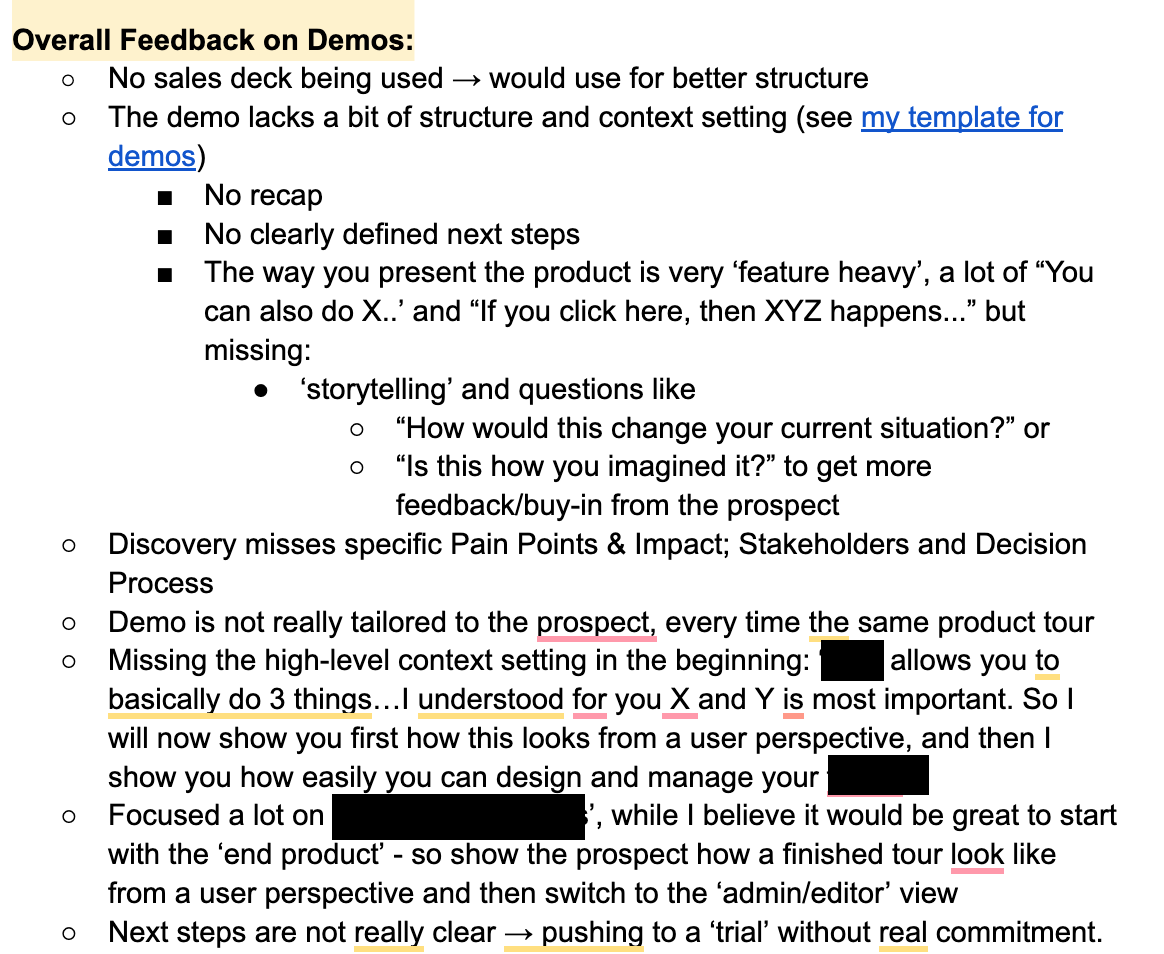

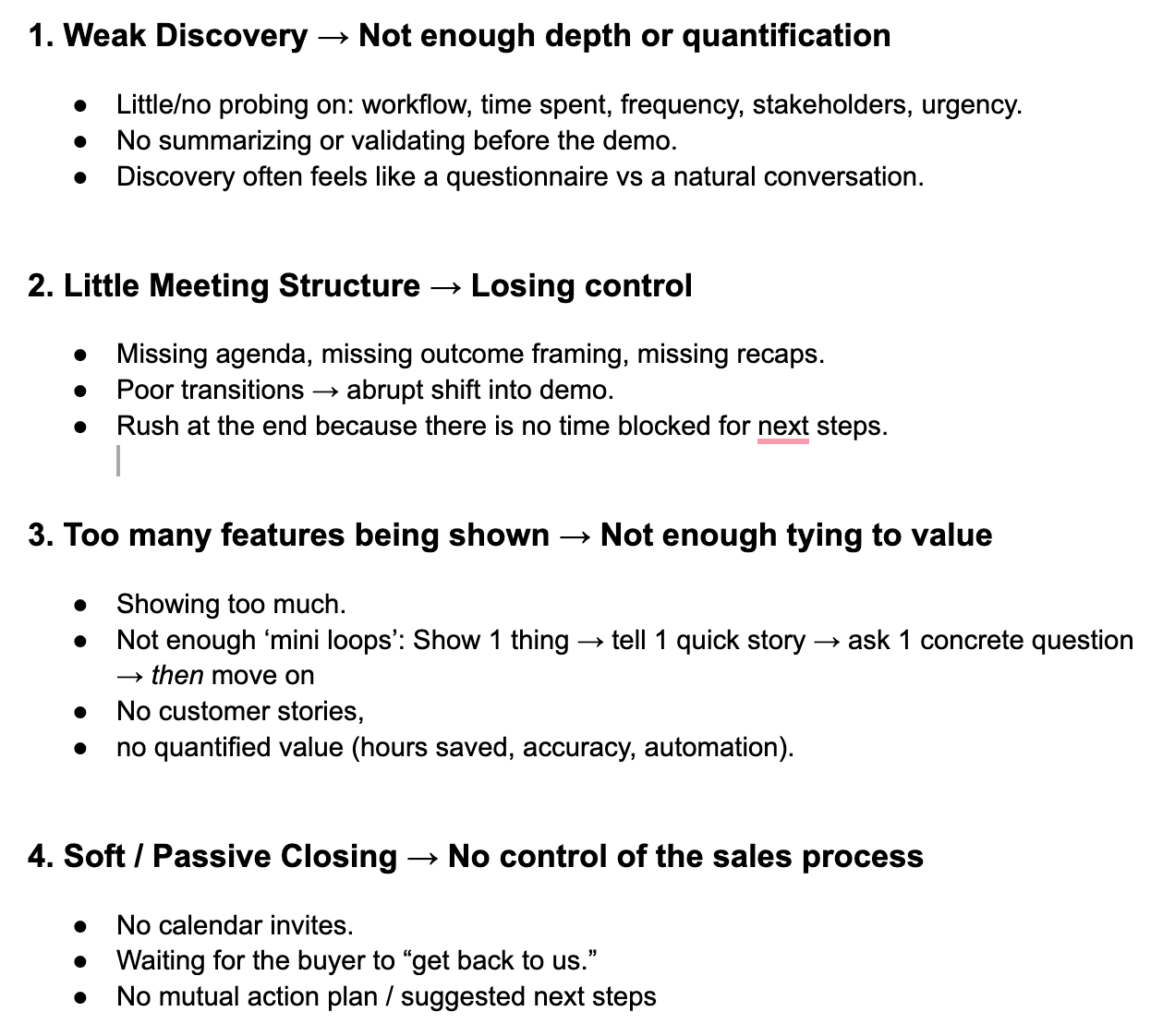

Here you see some real feedback on sales demo recordings.

If I were to summarize the most recurring issues, it’s these 4 👇

Ressources:

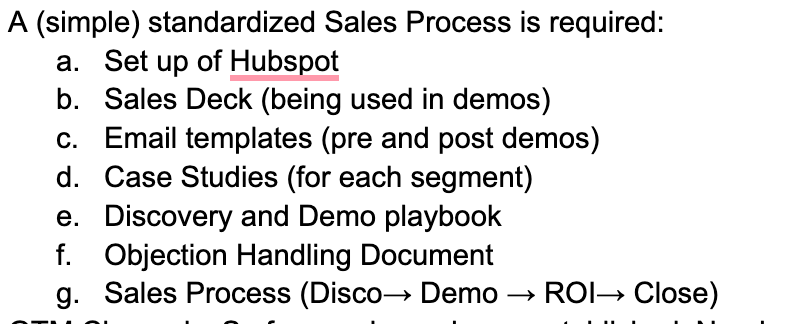

1. My new ‘B2B Sales Demo Toolbox”4. No clearly defined sales process

Pattern:

Sales is a set of calls, but not a designed journey.

Founders/sellers don’t guide prospects through a set of clearly defined steps, so they can’t describe what should happen after each step.

What this looks like in practice:

❌ “What happens after the first call?” depends on the person❌ No consistent goal for the first call vs demo vs follow-up❌ Deals are created without a clear definition❌ Trials are offered without commitment or success criteria❌ Deals stall because next steps were never designed👉 Whenever I ask founders to walk me through their sales process, this is where it breaks.

How to fix:

✅ Define a simple, explicit sales processe.g., Disco → Demo → Trial/Pilot → Close

✅ Assign a clear goal and exit criteria to each stage✅ Define when a trial is “earned” (qualification threshold)✅ Create standard follow-ups for each stage (post-demo, trial kickoff, recap)✅ Enforce pipeline hygiene: every deal needs a next step and close dateExamples of my GTM audit:

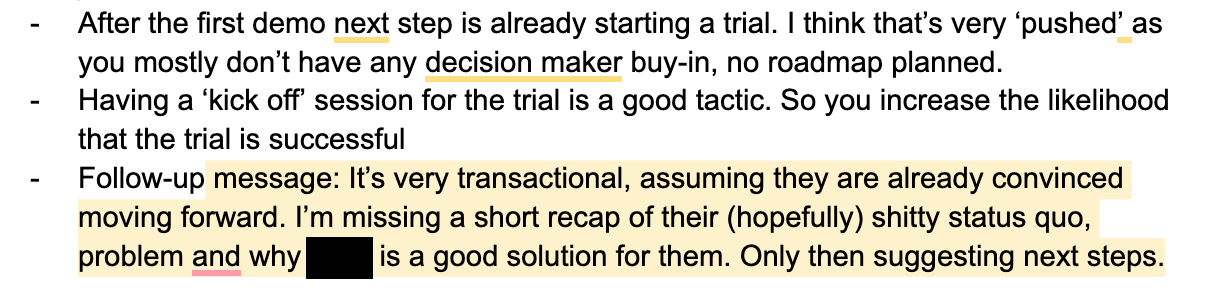

In several audits, sales activity existed, but nobody could clearly explain when a deal should be opened, advanced, or closed.

As a result, pipelines were full, but unreliable. Deals stalled not because of objections, but because the next step was never clearly defined.

👉 So write down your ideal sales process on paper!

Another thing that I see quite often is that exit/entry criteria are not well defined.

This lead for example, to pushing prospects too early to a ‘trial’ or ‘pilot’ without real commitment.

Ressources:

1. Buyer Journey Visualisation

2. Sales Email Templates for Follow Ups5. GTM assets are too generic

Pattern:

The strategy work is done in internal docs, but buyer-facing assets don’t reflect it.

I often review a team’s internal docs and think: “This is actually very good.”

Then I look at their website, CRM, sales deck, and content, and the clarity disappears.

What this looks like in practice:

❌ ICP and messaging frameworks live in Notion/Miro only❌ Homepage copy is fuzzy or overly technical (ICP doesn’t understand)❌ No clear callout of ICP, product category, or status quo problem❌ Sales decks are 80% product features presentations❌ LinkedIn profiles don’t explain what the product does and for whom❌ Strong insights exist, but prospects never see them👉 This one is painful because the thinking is usually very good.

How to fix:

✅ Translate ICP and positioning into the homepage hero✅ Update sales deck to follow: Status quo → pain → solution → proof → next steps✅ Align website, deck, demo narrative, outbound messages, content around the same story✅ Make LinkedIn profiles ICP-specific (headline, banner, featured assets)[Your role] @ [Company name] / We help [ICP] to do [usecase] without [problem]

[Your role] @ [Company name] / I help [ICP] achieve [result] by [what you do]

[Your role] @ [Company name] / The [product category) for [ICP]

✅ Build ICP specific content (Case studies, BOFU content, How to guides, Actionable Lead Magnets)Examples of my GTM audit:

In one audit, the internal messaging and ICP work were excellent.

But the website copy was generic, the sales deck hadn’t been updated, and LinkedIn profiles still used vague descriptions.

Ressources:

1. Sales Deck Template

2. Homepage Wireframe & Copywriting

3. Case Studies Guide

4. Lead Magnets Guide

5. LinkedIn Founder & Employee Guide6. Content is done, but without a strategy

Pattern:

Teams are “doing content”, but it’s disconnected from high-intent topics.

Content exists, but it isn’t designed to support real sales conversations or capture existing demand. This usually means teams are creating a lot of TOFU blog posts and random LinkedIn posts.

Results are usually 0 Inbounds.

What this looks like in practice:

❌ Random LinkedIn posts (or disconnected from ICP pain points)❌ No repeatable content format (every post is a different topic)❌ No Inbound generating lead magnet❌ TOFU blog posts that don’t attract buyers❌ Content optimized for likes, not ICP engagements❌ No measurement of pipeline influence👉 This almost always shows up together with weak inbound quality.

How to fix:

✅ Prioritize BOFU content: alternatives, comparisons, “best X for Y”, use-case pages✅ Focus early on the 5% of buyers who are already in the market ✅ Build a content map based on ICP questions by awareness stage (from problem-unaware → problem aware —> solution aware —> product (category) aware —> purchase-decision)✅ Build a high-performing lead magnet (that is ICP relevant)✅ Turn real sales objections into posts and articles✅ Record customer calls and use insights for your content roadmap (objections, pains, desired outcomes…)✅ Measure content by meetings influenced, not impressions (e.g. via self-reported attribution)Examples of my GTM audit:

Most companies today operate in a crowded market with established players. This allows you to capture existing demand.

Ressources:

1. BOFU Content Page Examples

2. 35+ LinkedIn post templates (for Founders)If there’s one takeaway from all these audits, it’s this:

Founders don’t lack ideas, effort, or tools.

Most GTM problems lie in the GTM foundation and struggle to bring these to life end-to-end.

If you recognize parts of your own GTM in this newsletter, take a moment and go through the provided fixes.

Most of the time, it’s not about doing more, but instead doing fewer things with consistency.

GTM Audit

If you feel stuck or want an external perspective, I offer a 360° GTM Audit:

Deep review of your current GTM

Clear gaps and priorities

A custom 6-month action plan

Delivered in 7 days

That’s it for today.

See you in 2 weeks.

3 ways I help founders build a strong GTM foundation 👇

1️⃣ Use my free GTM library with 50+ free resources (guides, templates, workbooks, and tools) to build a strong GTM foundation (helped 5000+ SaaS leaders)

2️⃣ Get a 360° GTM audit of your status quo + a custom 6-month action plan

3️⃣ Work 1-on-1 with me - GTM Advisory for SaaS founders from €0 to €1 million ARR

Interesting Read! Especially from a procurement perspective