Investor-Ready: Your Guide to Secure Early-Stage Funding in 2026

Bonus: Pitch Deck Template, Investor List

Hey - it’s Alex, this time together with Julius Göllner & Marc Penkala - some of the most active angels and early-stage VCs in Europe!

Today, we cover how to get your first investment in 2025 (and 2026) - a true practical guide.

In case you missed the last 3 episodes:

✅ The perfect product pages for your SaaS

✅ How to test your messaging to find message-market fit

✅ 14 actionable tactics for a better CRM

A quick word from our sponsors

📢 ARRtist Summit – The conference for B2B software & AI founders

Join ARRtist SUMMIT to meet 500 high-profile B2B software & AI founders and CxOs, and 125 B2B investors. Network with and learn from the most relevant European community in B2B software & AI.

Apply now for one of 500 founder/CxO tickets!

Use the code “MRR Unlocked” for exclusive discounted tickets.

Reach 20.000+ SaaS operators with sponsored content. Sponsor the next newsletter.

Every startup needs financial resources to build a product and go to market.

But one of the key question that every founder (team) need to ask themselves is:

“Do I need external capital or can I self-fund (aka. bootstrap) my business?”

So, before we dive into how to get your first funding from angels and (pre-) seed investors, we will give you a quick overview of when to raise vs. when to bootstrap.

P.S. Work on your positioning and messaging before you reach out to investors for external funding.

Bootstrapping vs. Raising Capital vs. Seed Strapping: How to make the decision.

Let us start with an abstract definition of each term:

Bootstrapping

Building and growing a business using personal savings, reinvested profits, or minimal external funding, relying on resourcefulness and cost efficiency instead of significant external capital.

Early-Stage Fundraising

The process of securing external capital, often from angel investors, (pre-) seed funds, or family offices, to support product development, market entry, and initial early scaling.

Seed Strapping

Seed strapping is a start-up growth strategy where founders raise a single (pre-) seed round to build momentum, then grow with revenue instead of chasing more funding rounds. It’s the middle ground between bootstrapping and early-stage fundraising.

The decision on what the right model for you depends on a set of variables:

✅ Growth ambition

✅ Market landscape/dynamics

✅ Business model & need for funding

✅ Ownership & control

✅ Preferred ‘lifestyle’

✅ Free cash flow / front-loaded payments

✅ Go-to-market and sales motion

Overview of funding options for early-stage

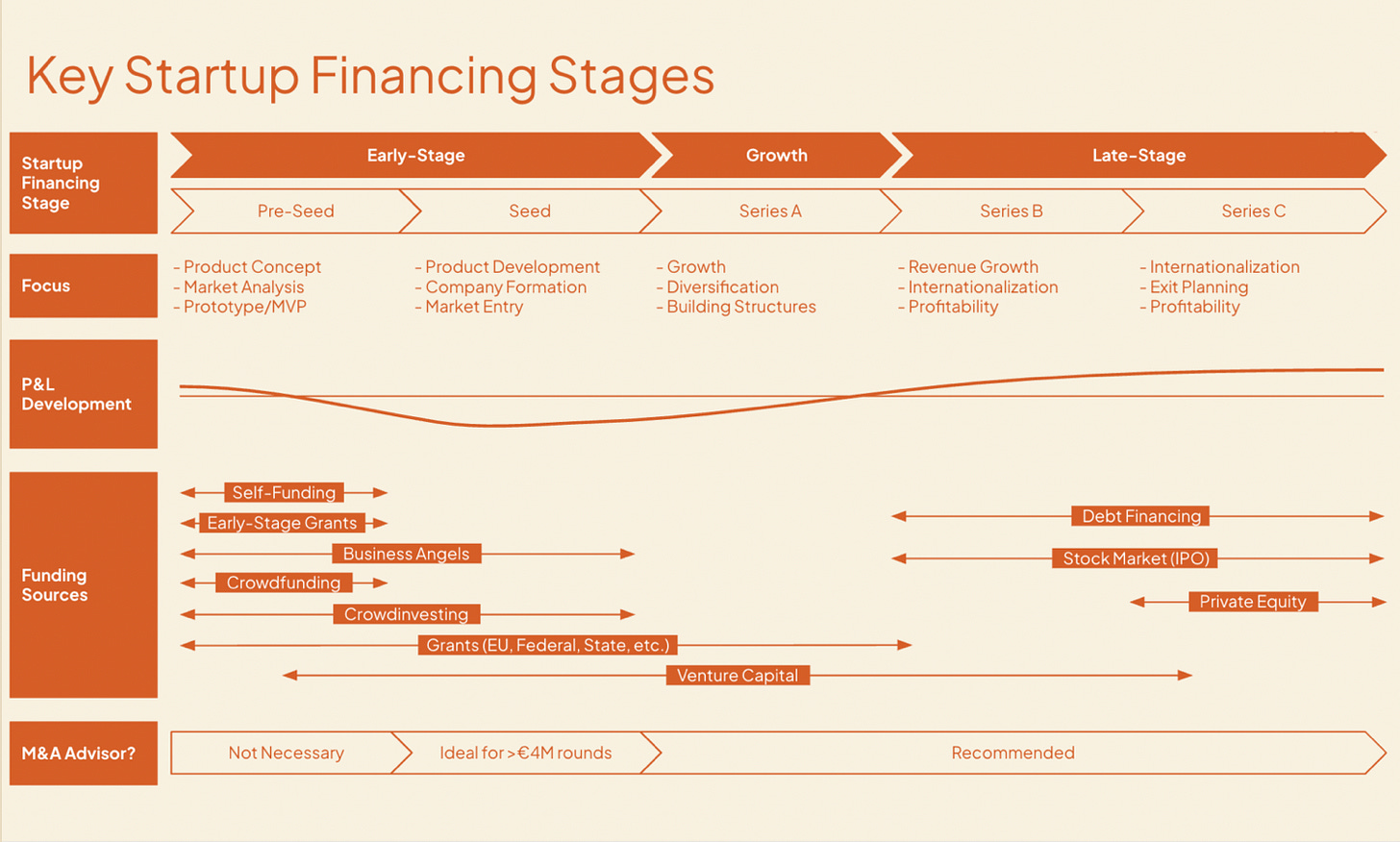

If you decide to pursue external funding, it’s helpful to understand the ‘funding journey’ from pre-seed to Series C.

But now, let’s have a closer look at the different early-stage funding options.

1️⃣ Family and friends and fools (“The 3 Fs”)

Informal investment from people you know.

✅ Best for:

Idea-stage (pre-revenue) companies

When raising a small pre-seed round (<€250k)

Trusted personal networks

Kickstarting a company to get to MVP or early PMF

2️⃣ Business angels & angel syndicates

Wealthy individuals who are investing early (usually €10k–€100k per investor).

✅ Best for:

Founders needing smart money (advice + cash)

Start-ups with early traction or mass market potential

Founders with a strong network / large tech spin-offs (start-up Mafias)

Tips:

✅ Target angels who’ve built companies in a similar space or backed other SaaS products in that niche (or industry experts).

✅ Add structure (CLA overpriced round) and angel pooling sub 50k € cheques.

You usually have 2 options to structure your Business angels & angel syndicates investment.

Option 1: Pre-Seed Priced Equity Round

Founders sell shares at an agreed valuation, giving investors immediate equity ownership in the company.

Pros:

✅ Clear ownership structure from day one.

✅ No debt obligations or interest.

✅ Attracts investors seeking defined equity stakes.

✅ Reduces uncertainty around future valuations.

Cons:

❌ Dilution for founders occurs immediately.

❌ Valuation negotiation can be difficult at a very early stage.

❌ Legal and administrative costs are typically higher.

❌ Distracting the founders / time-consuming

Option 2: Convertible Loan Investment (Convertible Note / CLA)

A loan that converts into equity at a later funding round, often with a discount or valuation cap, rather than being repaid in cash.

Pros:

✅ Faster, cheaper, and simpler to execute.

✅ Defers valuation discussion until later (when more traction exists).

✅ Provides flexibility for both founders and investors.

✅ Often includes investor-friendly incentives (discounts, caps, interest).

Cons:

❌ Creates debt on the balance sheet until conversion.

❌ Interest may accrue, increasing dilution at conversion.

❌ If no future round occurs, repayment obligations may arise.

❌ Misaligned incentives if terms heavily favor investors.

👉 Here are lists of active and trusted business angels:

3️⃣ Accelerator/Incubators and talent investor funding

Incubators and Accelerators

These work with already formed founding teams that have at least an initial idea or prototype.

They provide a structured program with mentoring, community, and resources to help these teams sharpen their product, validate their market, and prepare for fundraising.

In return for equity, they also offer early capital and access to a strong investor and alumni network.

Examples: Y Combinator, Techstars, TinySeed, On Deck, EWOR, PnP

Talent investors

Talent Investors back individuals before they even have a company.

Instead of waiting for teams with a ready-made product, they select talented people, bring them together in a structured program, and help them find co-founders with complementary skills.

Within this environment, participants test and refine ideas, validate business models, and, if they find traction, receive a first pre-seed investment.

Examples: Antler, Entrepreneur First or MVP Founders.

What it is: Programs that offer small investments (€100k–€250k) plus mentorship, community, and demo day exposure.

✅ Best for:

First-time founders

Pre-seed to seed stage

Need guidance/networking

Seek access to investors / Angels

Teams that are not complete. lacking a co-founder

⏳ Typical Terms: 6–10% equity for access and cash

4️⃣ Venture capital

Early-stage venture capital funds write checks from €100k to €1m and above.

✅ Best for:

Large market opportunity (Large TAM)

Fast-scaling SaaS with traction / high usage

Founders ready for aggressive growth and fundraising cycles

Serial entrepreneurs and domain experts with particular intel

This path requires:

Clear path to 100x+ return (Min. expectation fund returner potential)

Willingness to give up board seats, control at a later point

👉 Here are lists of active VCs (in Europe):

OpenVC shared some great VC lists

1600+ Seed stage Investors in Europe (by Dealroom)

5️⃣ Non-dilutive grants

Free “non-dilutive” grants from governments, NGOs, universities, or industry-specific funding programs.

✅ Best for:

Research-heavy startups or deep-tech startups

Be aware of long application processes and paperwork.

We recommend working with agencies that do the administrative stuff for you, such as Sector Pi.

Here’s a short list of options:

funding programs in Germany like Exist, Invest, or High Tech Gründerfond

Speedinvest also shared a list of 25 non-dilutive funding options for startups in Europe.

Now that we know the different funding options, let’s have a look at what you need in 2025/2026 to raise money from business angels and early-stage VCs for your pre-seed round.

P.S. In a bit later stages, some hybrid models might be a good fit for you, e.g., revenue-based financing (above 1€ million ARR) or indie VC funding (e.g., Atempo, Float, Re:Cap, etc.)

The funding landscape in 2025: 8 Key shifts from prior years.

The funding landscape changed in the last 12 months. Here’s what Julius and Marc observed over the last 12 months when it comes to raising a pre-seed and seed round:

1️⃣ Fundraising takes much longer (expect 6-9 months)

2️⃣ Traction expectations ramped up, early traction is king

3️⃣ Most investments shifted into vertical AI (enabled) / SaaS / Agentic AI

4️⃣ Since Tech becomes a commodity, GTM and data are the new moats

5️⃣ Strong shift from hypergrowth to strong unit economic profitability

6️⃣ Capital efficiency becomes key (e.g., revenue per FTE)

7️⃣ Default alive mentality/founder mindset

8️⃣ Raise what you need and not what you can

What investors want to see at pre-seed

This one is a bit harder to generalize, because every investor has their own mindset when it comes to investment.

But overall, founders need 5 things to raise their first investment.

1️⃣ Clear problem & insight

Investors want to see that founders have:

Identified a pain point that’s urgent, specific, and underserved

unique insight or unfair advantage (domain expertise, founder–market fit)

Killer must-have application instead of a nice-to-have application

Strong defensibility edge over competitors/incumbents

Ideally, the founders can tell a compelling story of how market shifts create painful problems.

2️⃣ Early Traction / Signals

At the pre-seed and seed stages, unit economics are usually not a key consideration. Instead, investors want to see good signals.

This includes ideally:

Quantitative signals (market/business model relevant KPIs)

Qualitative signals (case studies and customer interviews)

We know that’s a bit fluffy, so let’s have a look at some relevant funding benchmarks.

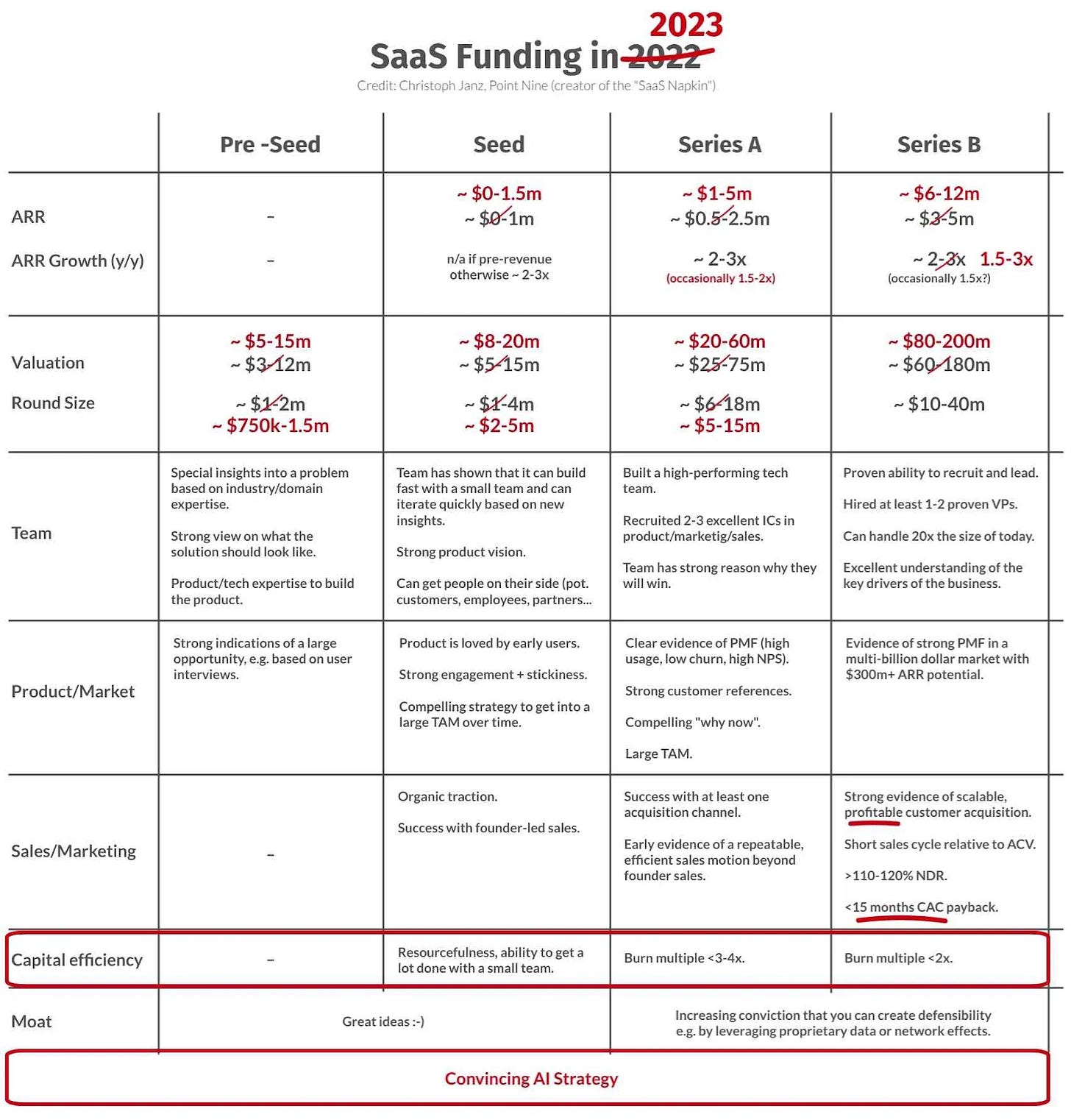

Point 9 Partner Christoph Janz was the first one sharing ‘SaaS funding napkins’ - the latest version is from 2023. 👇

There’s no Napkin for 2024 or 2025, but we believe that in the pre-seed stage, the following is true:

✅ You need more than a prototype. Early revenue (even if small), usage metrics, customer feedback, and possibly some paying customers.

✅ Investors are much less willing to accept “growth at all costs” without showing early signs of efficient growth.

✅ Early signs of good net expansion (NRR) are highly welcomed

✅ Clear path to €1m ARR (defensible GTM strategy), including a reasonable valuation lift-up between the pre-seed and seed round.

Building in deep-tech, the first momentum napkin 2025 gives a good overview. 👇

If you build in the biology/scientific space, the Nucleus Capital Napkin gives a good overview.

3️⃣ Big or fast-growing TAM

TAM/SAM/SOM is important because VCs invest in scalability and outsized returns.

A compelling market size story shows that, if the startup executes well, it can grow into a category-defining company big enough to return the fund.

Sizing the Opportunity

TAM (Total Addressable Market): Shows the maximum revenue potential if the startup captured 100% of the market.

SAM (Serviceable Available Market): Narrows this to the segment realistically served by the startup’s product/service.

SOM (Serviceable Obtainable Market): Focuses on the share the startup can realistically win in the short-to-medium term.

→ This framework helps VCs assess whether the opportunity is large enough to justify venture-scale returns.

P.S. Majd Alaily shared 3 practical ways to calculate your TAM: Bottom Up, Top Down or Value Based.

Return Potential

Venture capital funds rely on a few big winners to deliver portfolio returns.

A startup must show the potential to scale into a hundred-million or billion-dollar company, which is only possible if the TAM (and thus the SAM/SOM) is sufficiently large.

→ VCs evaluate if you can be a potential fund returner for them. Jason Lemkin wrote a great guide on this.

Risk Assessment

A small or poorly defined market increases the risk that even a great team/product cannot achieve meaningful growth.

A clear TAM/SAM/SOM analysis reduces uncertainty about scalability and market adoption.

Strategic Fit

Helps VCs understand if the startup’s go-to-market strategy (SOM) is realistic and whether the business model can expand into larger segments (SAM, TAM) over time.

4️⃣ Clarity in GTM / unfair advantage

When you’re raising your first VC investment, you’re most probably early and don’t have a robust go-to-market in place.

What they want to see is that you think strategically about your GTM and do lots of tests to see what works and what doesn’t.

They need to believe that you understand your Ideal Customer Profile, work on your unique positioning, develop a strong messaging, and invest in the right sales motion and growth channels - aka. build a strong GTM foundation.

They want to see early signals that you build a strong (founder-led) go-to-market motion.

5️⃣ Founder's edge: What makes you uniquely suited to win.

They will evaluate if:

1️⃣ The current team is skilled enough to run the different parts of the company (product, tech, GTM)?

2️⃣ Your team is complementary and ready to execute without additional key hires in the 0 to 1 period?

3️⃣ Do you have any unique skills in the team (e.g,. industry expertise, track record…)

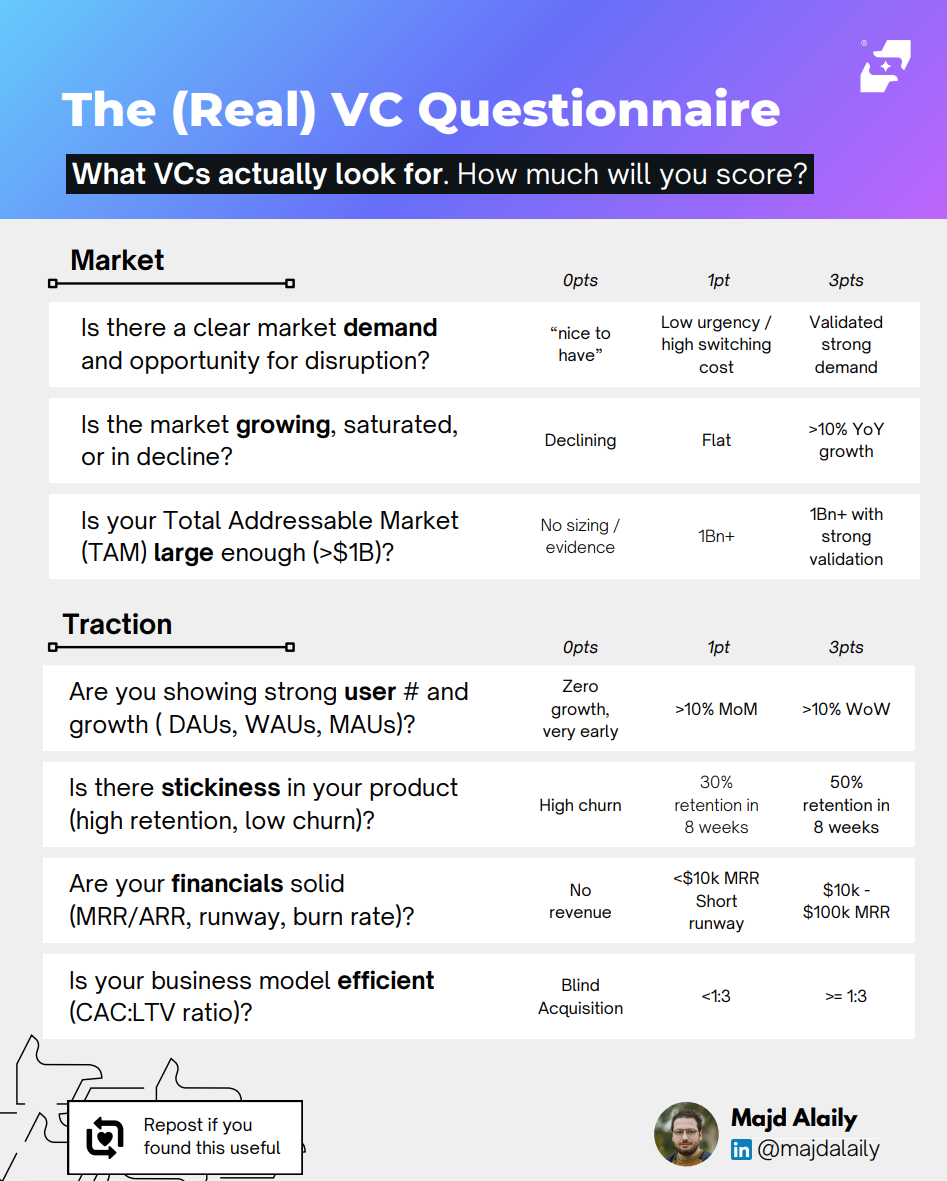

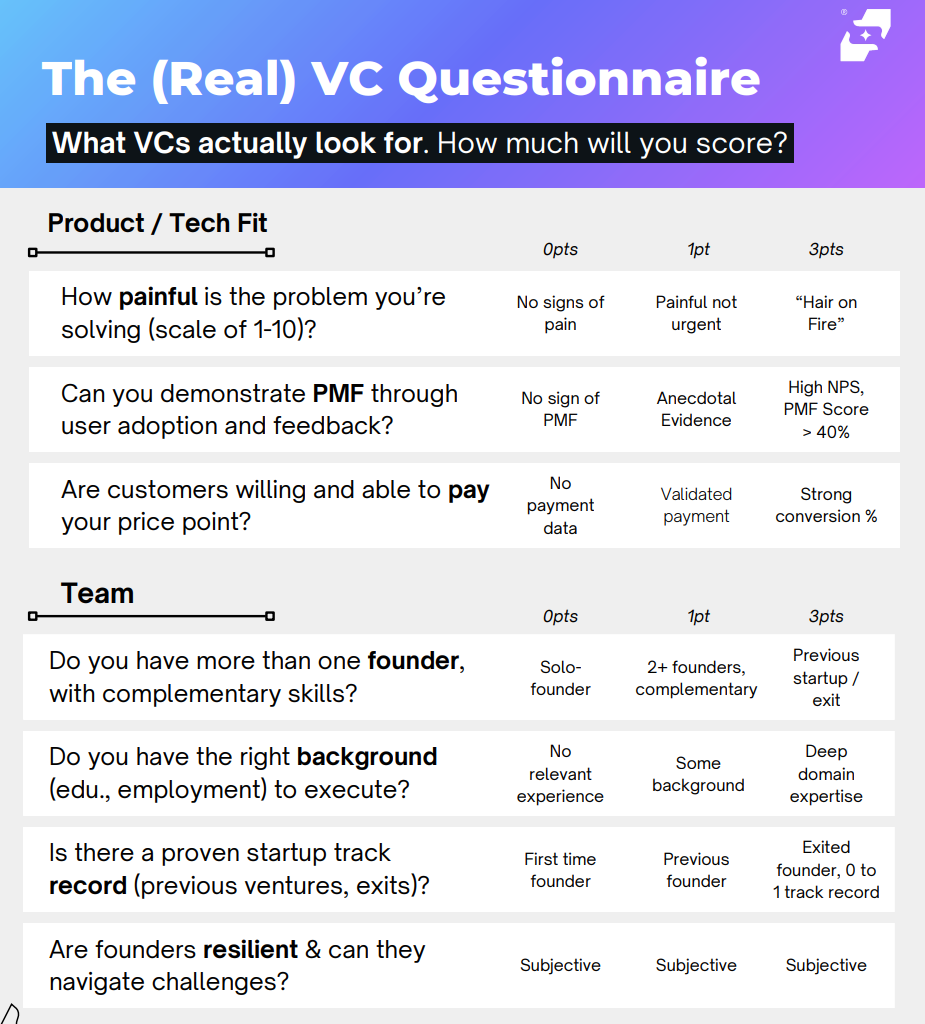

While we did some research on our guide, we found another great overview from Majd Alaily and Chris Tottman (from Notion Capital) on what VCs actually look for and how they evaluate you.

So now you know what investors expect from you.

Fundraising Operations

So let’s get a bit more tactical. The 3 most common questions we get are:

When is the right time to raise?

How do I find the right investors?

What documents do I need for fundraising?

When is the right time to raise?

Good times to raise

As we mentioned earlier, fundraising takes 6-9 months.

But keep in mind that fundraising also has its own seasonality, so summer months and December/January are usually a stretch. If possible, don’t aim for closing a round at that time.

Active vs. Passive Fundraising

Fundraising usually happens in two phases: a passive and an active one.

In the passive phase, founders start building relationships with a carefully selected list of target investors 6-12 months before they officially open a round. This means staying on their radar, sharing occasional but limited updates, and creating familiarity without asking for money yet.

When the time comes to move into the active fundraising phase, these investors already know the team and their progress, which builds trust and significantly shortens decision cycles.

Done well, passive fundraising turns the later active phase from cold outreach into warm, momentum-driven conversations.

How to find the right investors

Winning your first investors is a bit like winning your first clients. The name of the game is volume after all.

Here are a few tactics to keep in mind:

✅ Start with all the angels / VCs you DON’T want to have to test your deck and practice your pitch to refine it before you go for the real “gold nuggets”.

✅ Ask your inner network for introductions

✅ Try getting referrals and warm intros (a must)

✅ Focus on ‘high-fit’ and active investors

✅ Start early (passive fundraising) to build relationships (feed them with monthly updates)

✅ Activate your cheerleaders (The angels you win are the best fundraisers)

✅ Send out deck and tailored outreach messages (touchpoints and why they are a great fit based on their portfolio or focus)

But getting investors to a first call is just the first step of your fundraising process.

It’s the same as sales. Usually, you don’t close a deal on your first call.

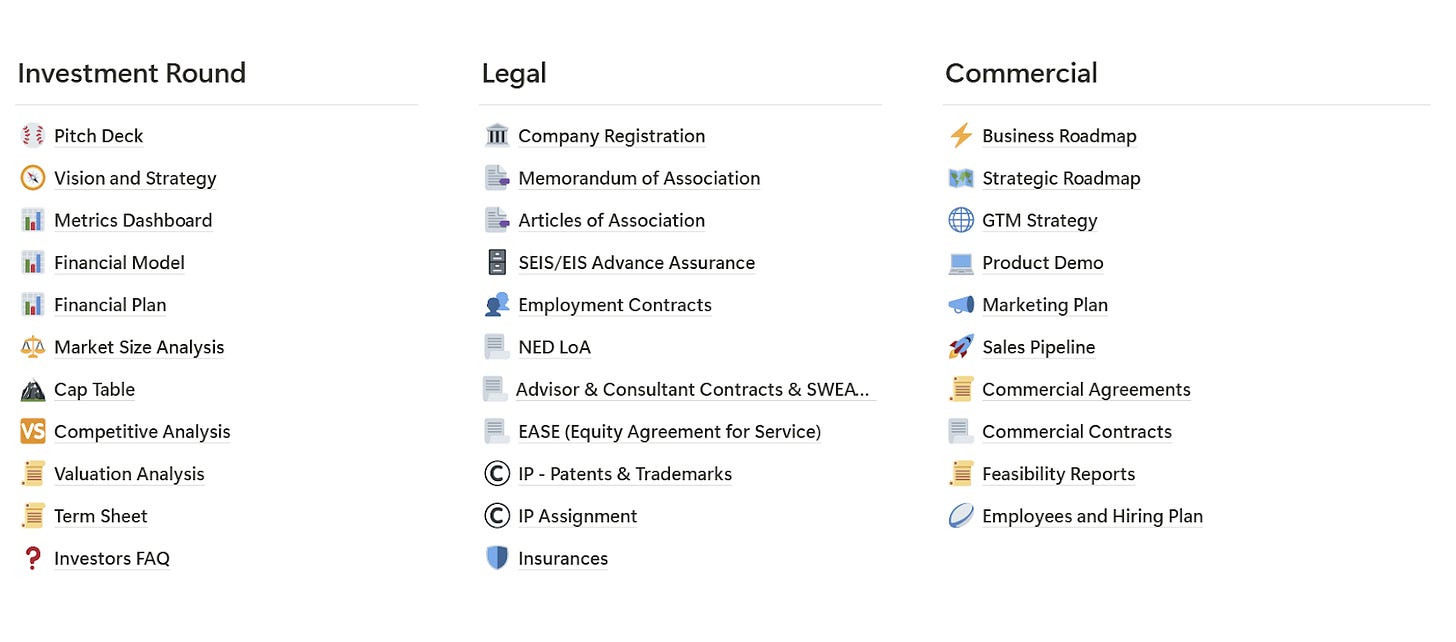

What documents do I need for fundraising?

When you decide to start raising external money (from VCs and angels), you need to prepare the right documents.

We recommend having:

Short Intro Pitch Deck (6-10 slides)

Longer Pitch Deck (10-20 slides + backlog slides)

Data Room with a lot more insights (only shared after first conversations)

Pitch Deck

If you’re looking for great pitch deck templates, check out these 3 awesome templates:

1️⃣ Pitch Deck Template by Majd:

2️⃣ Pitch Deck Template by Addedval

3️⃣ Pitch Deck Template by co-author āltitude

And don’t make your pitch deck full of fluff. As Burak Buyukdemir said, it’s the fastest way to kill your investors’ interest.

In his recent LinkedIn post, he shared what VCs actually want to see in your pitch deck 👇

Data Room

Your data room is a shared folder/hub, where you store and share critical company documents (e.g., financials, cap tables, GTM strategy, etc.) with potential investors.

Andreas Mitschke provides a great Notion data room template for startups.

P.S. If you need hands-on support building your pitch deck and running an effective fundraising process, consider the support from experts like Nikola Yanev or Matthias Voss.

Acceptable Dilution for first investments

Let's add some thoughts around fundability and cap table hygiene - what are acceptable dilution ranges and how should a cap table look (founder share / ESOP / Advisor/investors) post pre-seed.

For CLAs (Discounts, Caps)

Even in pre-seed rounds, there is a broad range of pre- and post-money caps, which may range between €3m and €20m, while the majority rather range between €5m and €8m (pre-money cap).

Discounts are usually set at around 20%. Competitive cases may have a 15% discount, while distressed start-ups may offer up to 30%.

Interest rates may range between 3% and 8%, upon conversion. Accrued interest may have a high impact on overall dilution (based on the converting amount, principal plus interest).

Some CLAs, as well, include a floor. A floor conversion sets a minimum company valuation at which the loan will convert into equity.

In other words, even if a future financing round values the company very low, the CLA will convert as if the valuation were at least the floor.

Equity Round

An optimal pre-seed cap-table has only the founders on it - in a perfect world, there are two to three founders, all with a unique super power. A single founder always bears a certain risk, and more than three founders lead to low per-founder equity ownership and higher conflict potential in the founding team.

An optimal post pre-seed cap-table leaves the founding team with at least 80% of ownership, while up to 20% goes to investors, in addition to a 10% ESOP.

P.S. Cherry Ventures shared a great article on the ‘cap table magic’.

Terms Sheets

There’s a lot of uncertainty about what a fair term sheet looks like.

Below you’ll find the unveiled term sheet template from Cherry Ventures.

After the term sheet, the closing follows.

Congrats, but the investor relationship is not over with the closing.

So let’s have a closer look at how you should manage your investor relationship.

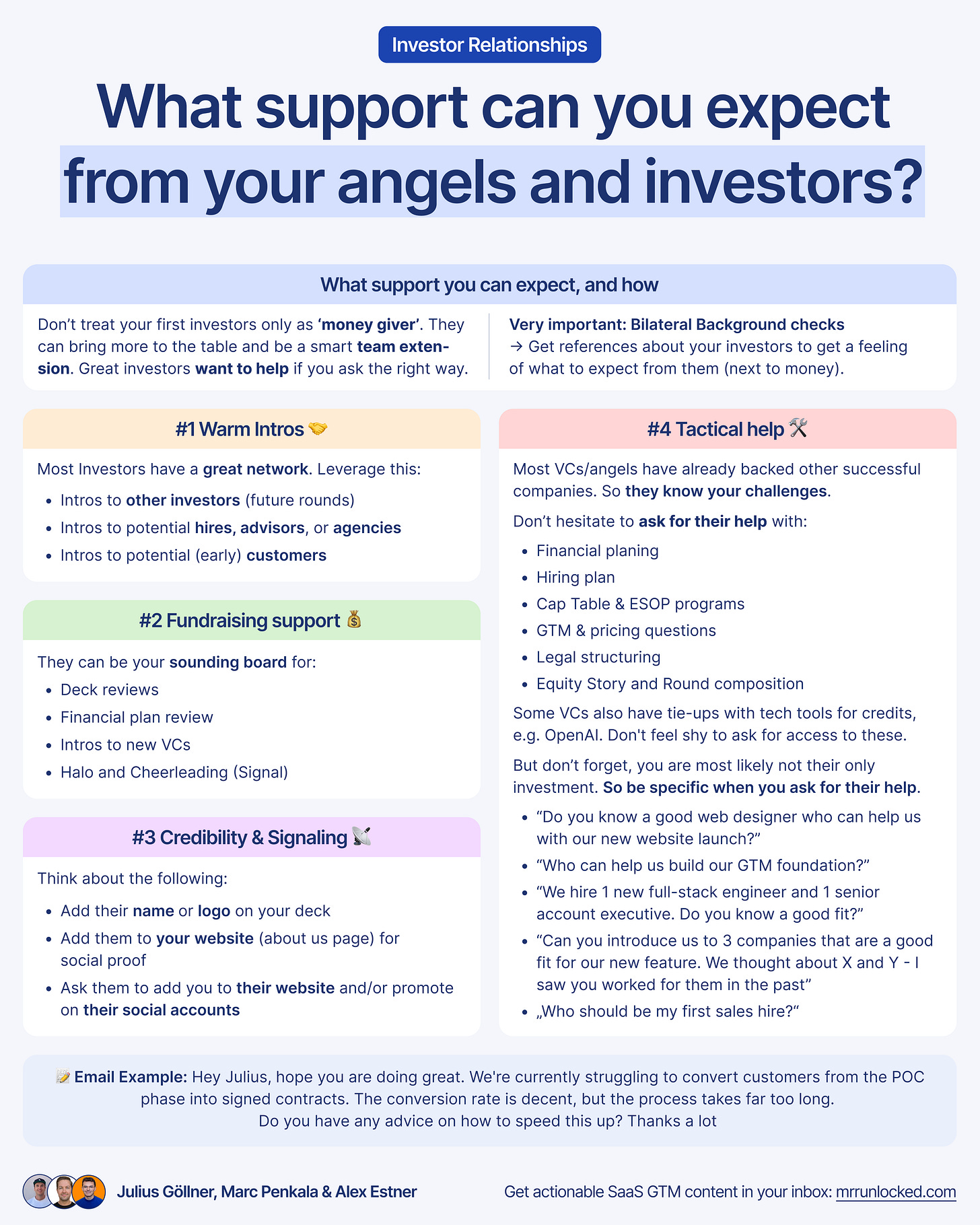

Investor Relationships (with your Investors)

Don’t treat your first investors only as ‘money giver’ - they can bring a lot more to the table and can be a smart ‘team extension’.

What support can you expect, and how

VERY important bilateral Background checks, get references about your investors to get a feeling of what to expect from them (next to money). Always opt for Intel / Access and Network Angels (every Angel should bring a superpower)!

The great investors also want to help if you ask the right way.

Here’s a list of how investors can support you:

1️⃣ Warm Intros

Most Investors have a great network. Leverage this:

Intros to other investors (future rounds)

Intros to potential hires, advisors, or agencies

Intros to potential (early) customers

2️⃣ Fundraising support

They can be your sounding board for:

Deck reviews

Financial plan review

Intros to new VCs

Halo and Cheerleading (Signal)

3️⃣ Credibility & Signaling

Think about the following:

Add their name/logo on your deck

Add them to your website (about us page) for social proof

Ask them to add you to their website and/or promote on their social accounts

4️⃣ Tactical help

Most VCs/angels have already backed other successful companies. So they know your challenges.

Don’t hesitate to ask for their help, e.g.:

Financial planning

Hiring plan

Cap Table & ESOP programs

GTM & pricing questions

Legal structuring

Equity Story and Round composition

However, don’t forget that you are most likely not their only investment.

So be specific when you ask for their help.

“Do you know a good designer who can help us with our new website?”

“Who can help us build our GTM foundation?”

“We hire 1 new full-stack engineer and 1 senior account executive. Do you know a good fit?”

“Can you introduce us to a few companies that might be a good ICP fit. We thought about X and Y - I saw you worked for them in the past.”

„I am preparing our Seed Pitch Deck and heard that the TAM, SAM, SOM logic is outdated at Investors. What’s your take?“

„Who should be my first sales hire?“

„My sales cycles are way too long. How can I fasten my closing?“

The founders who get the most out of their investors are the ones who:

✅ Send short, focused updates

✅ Ask for specific help

Good Update Emails

Once you have investors on board, they expect monthly update emails.

A good monthly update email is short, structured, honest, and easy for investors to scan, understand, and help.

✅ Consistent structure (same format every month)

✅ Typical sections are: Highlights, Lowlights/challenges, Key Metrics, Asks

✅ Easy to read (no fluff, no super detailed explanations)

Below you find an example of a good update email.

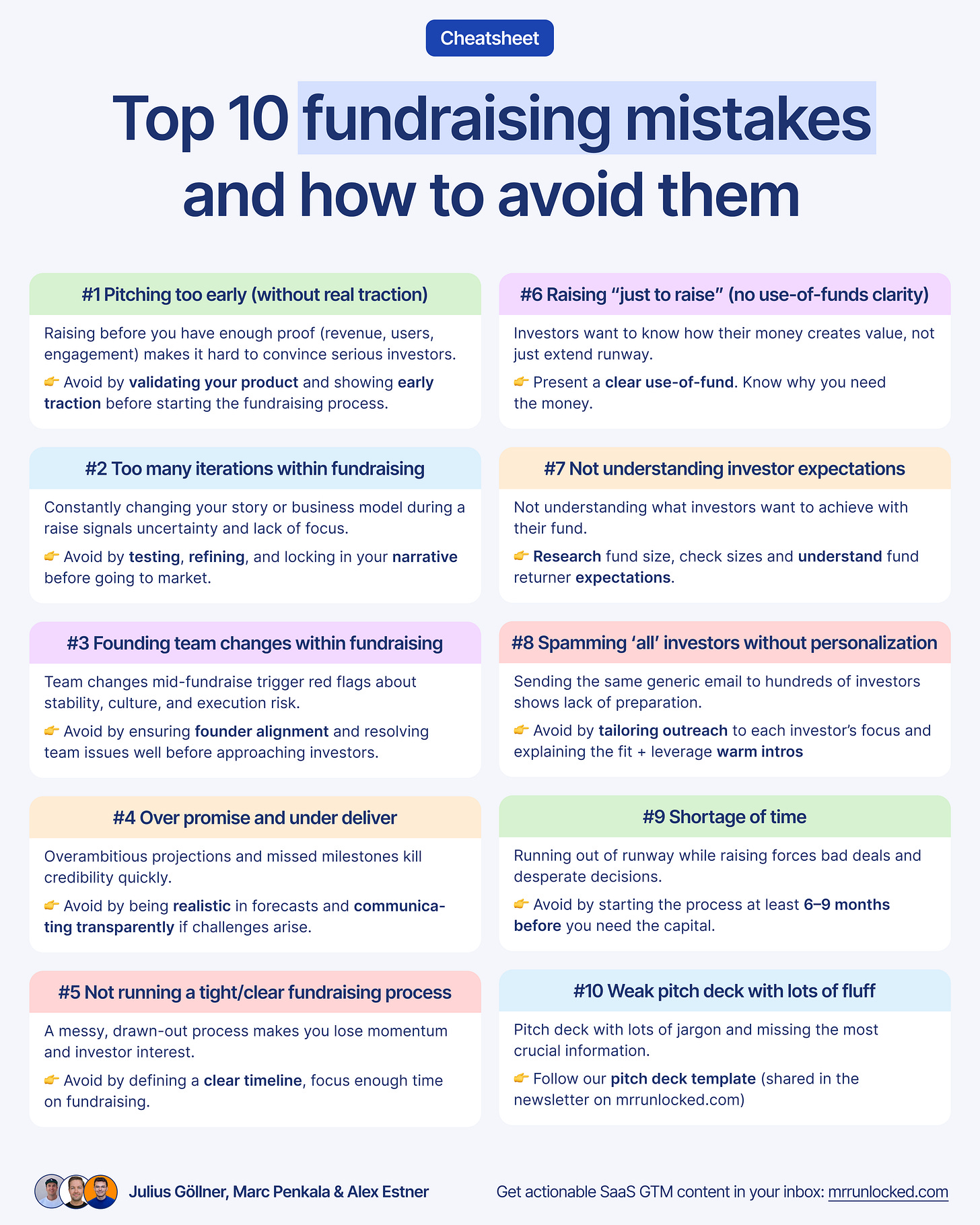

Top 10 fundraising mistakes & how to avoid them

❌ Pitching too early (without real traction)

Raising before you have enough proof points (revenue, users, engagement) makes it hard to convince serious investors.

👉 Avoid by validating your product and showing early traction before starting the fundraising process.

❌ Too many iterations (product, model…) within the fundraising

Constantly changing your story or business model during a raise signals uncertainty and a lack of focus.

👉 Avoid by testing, refining, and locking in your narrative before going to market.

❌ The founding team is changing within fundraising

Team changes mid-fundraise trigger red flags about stability, culture, and execution risk.

👉 Avoid by ensuring founder alignment and resolving team issues well before approaching investors.

❌ Over promise and under deliver

Overambitious projections and missed milestones kill credibility quickly.

👉 Avoid by being realistic in forecasts and communicating transparently if challenges arise.

❌ Not running a tight/clear fundraising process

A messy, drawn-out process makes you lose momentum and investor interest.

👉 Avoid by defining a clear timeline, focus enough time on fundraising.

❌ Raising “just to raise” with no use-of-funds clarity

Investors want to know how their money creates value, not just extend runway.

👉Present a clear use-of-fund. Know why you need the money

❌ Not understanding investor expectations

Not understanding what investors want to achieve with their fund

👉Research fund size, check sizes, and understand fund returner expectations

❌ Spamming ‘all’ investors without personalization

Sending the same generic email to hundreds of investors shows a lack of preparation.

👉 Avoid by tailoring outreach to each investor’s focus and explaining the fit + leverage warm intros

❌ Shortage of time

Running out of runway while raising forces bad deals and desperate decisions.

👉 Avoid by starting the process at least 6–9 months before you need the capital.

❌ Weak pitch deck with lots of fluff

Pitch deck with lots of jargon and missing the most crucial information

👉 Follow our pitch deck template (shared earlier)

Now you know how to raise your first investment.

Happy growth 🚀

3 ways I can help you grow your SaaS to €1 million ARR 👇

1️⃣ Use my free GTM library with 50+ free resources (guides, templates, workbooks, and tools) to build a strong GTM foundation (helped 5000+ SaaS leaders)

2️⃣ Get a 360° GTM audit of your status quo + a custom 6-month action plan

3️⃣ Work 1-on-1 with me - GTM Advisory for SaaS founders from €0 to €1 million ARR